Request for Payments Aging digital invoices

How to Request for Payments Aging digital invoices

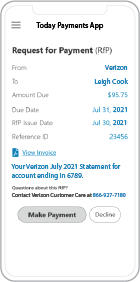

Request for Paymentsment, a new standard for digital invoicing facilitating real-time payments RTP ® and FedNow ®

payments that are instant, final (irrevocable - "good funds") and

secure.

Request for Paymentsment, a new standard for digital invoicing facilitating real-time payments RTP ® and FedNow ®

payments that are instant, final (irrevocable - "good funds") and

secure.

Our solution involves working

with spreadsheets in Excel and Google Sheets to integrate

Request for Payments Aging digital invoices, dealing with a

manual or semi-automated process. Below are some

recommendations for optimizing your solution:

1. Spreadsheet Setup:

- Data Structure:

Design your spreadsheet with structured columns to

accommodate relevant information such as invoice

number, amount, due date, and aging details.

- Automation with

Formulas: Leverage spreadsheet

formulas (e.g., SUMIFS, VLOOKUP) to automate

calculations, including aging. Ensure formulas are

dynamic to accommodate changes in the data.

2. Integration with Request

For Pay Aging Invoices:

- Data Entry Process:

Streamline the data entry process for Request for Payments

Aging invoices. Consider using forms or templates to

maintain consistency and reduce errors.

- Data Validation:

Implement validation rules within the spreadsheet to

ensure accurate data entry. This may include dropdown

lists, data validation checks, and conditional

formatting.

3. User-Friendly Interface:

- Instructions and

Guidance: Provide clear instructions

within the spreadsheet for users. Include tooltips or

guidance on how to enter and update Request for Payments

Aging information.

4. Automation Scripts:

- Google Apps Script

(Google Sheets): If using Google

Sheets, consider utilizing Google Apps Script to

automate repetitive tasks. This could include automated

data fetching, calculations, and updating aging

information.

- VBA Macros (Excel):

For Excel, explore the use of Visual Basic for

Applications (VBA) macros to automate tasks. This may

include automating data entry, calculations, and other

processes.

5. Data Validation and

Quality Control:

- Regular Audits:

Conduct regular audits of the spreadsheet data to

identify discrepancies or errors. Implement checks to

ensure data quality.

6. Integration with External

Systems:

- APIs or External Data

Sources: If feasible, explore options

to integrate your spreadsheet solution with external

systems or APIs that provide Request for Payments Aging

information. This could reduce manual data entry.

7. Collaboration Features:

- Google Sheets

Collaboration (Google Sheets): If

using Google Sheets, leverage collaboration features to

allow multiple users to work on the spreadsheet

simultaneously. Ensure proper access controls.

8. Documentation and

Training:

- User Guides:

Create user guides or documentation explaining how to

use the spreadsheet for Request for Payments Aging. Include

step-by-step instructions and best practices.

9. Security:

- Access Controls:

Implement access controls to ensure that only

authorized personnel can make changes to the

spreadsheet. This is crucial for maintaining data

integrity.

10. Regular Backups:

- Backup Procedures:

Establish regular backup procedures for your

spreadsheet data. This ensures that important

information is not lost in case of accidental deletions

or errors.

11. User Training:

- Training Sessions:

Conduct training sessions for users to familiarize them

with the spreadsheet solution. Address common

challenges and provide tips for efficient use.

12. Continuous Improvement:

- Feedback Mechanism:

Establish a feedback mechanism to gather input from

users. Use this feedback to identify areas for

improvement and implement updates accordingly.

By incorporating these

recommendations, you can enhance the efficiency, accuracy,

and usability of your solution that involves spreadsheets

for managing Request for Payments Aging digital invoices.

ACH and both FedNow Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions.

The versions that

NACHA and

The Clearing House Real-Time Payments system for the Response to the Request are pain.013 and pain.014

respectively. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP® and FedNow ® versions are "Credit

Push Payments" instead of "Debit Pull.".

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.