QuickBooks ® Request for Payment (RfP) Invoicing for Real-Time Payments

See

the features

QuickBooks® ACH, Cards, FedNow and Real-Time Payments

- Payment processing for all QuickBooks desktop, Pro, Premier, Enterprise and also QBO QuickBooks Online Our software is designed for simplicity and ease-of-use.

- ~ Automate Account Receivable Collection

- ~ Automate Account Payable Payments

- ~ One-time and Recurring Debits / Credits

Secure QB Plugin payment processing through QuickBooks ® specializes in the origination of moving money electronically.

Ask about our special:

Request for Payments

Merchants who use QuickBooks Online (QBO) or QuickBooks Enterprise for accounting can integrate ACH and FedNow Real-time Payments into their invoicing workflows using a solution like SecureQBPlugin. Below is a detailed guide to help merchants set up and use ACH and FedNow real-time payments for Request for Payment invoicing within these QuickBooks environments.

1. Overview of the Setup

- QuickBooks Online (QBO) and QuickBooks Enterprise are popular accounting software platforms used by merchants to manage their finances.

- ACH (Automated Clearing House) payments allow for secure, bank-to-bank transfers that generally settle within 1-3 business days.

- FedNow Real-Time Payments enable merchants to receive payments instantly.

- Request for Payment functionality allows you to send invoices to customers with a prompt for immediate payment, including ACH and FedNow options.

- SecureQBPlugin acts as an integration tool to connect QuickBooks (Online or Enterprise) with payment processors to enable these payment methods.

2. Setting Up ACH and FedNow Payments for QuickBooks Online and Enterprise

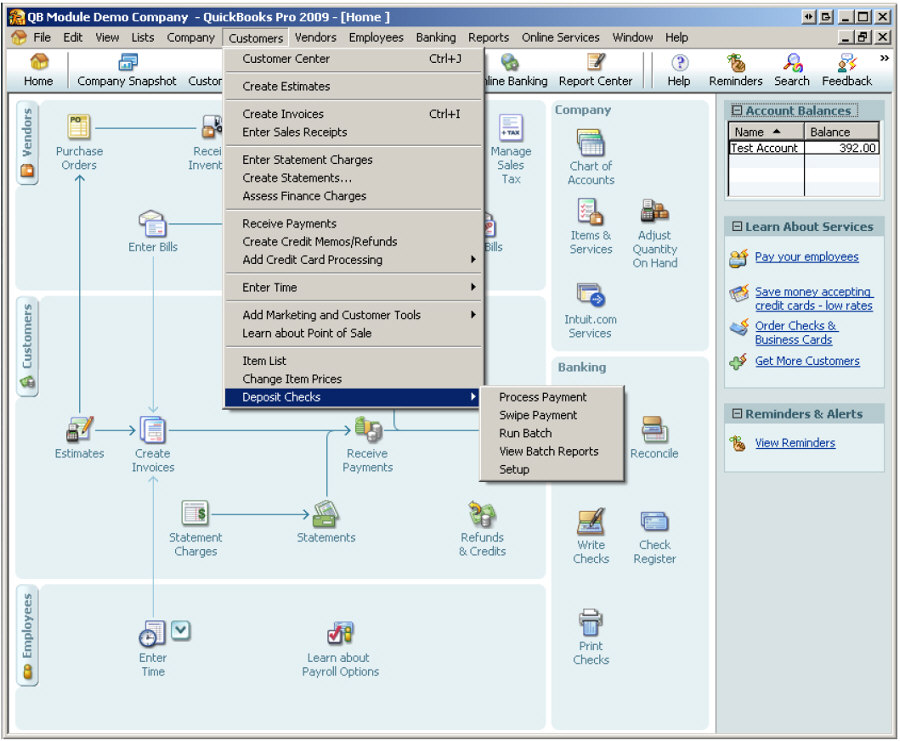

Step 1: Install and Configure SecureQBPlugin

- Go to SecureQBPlugin.com and download the plugin that corresponds to your version of QuickBooks (Online or Enterprise).

- Follow the installation steps provided to link SecureQBPlugin with your QuickBooks account.

- Once installed, you’ll need to configure the plugin to connect to your bank or payment processor that supports ACH and FedNow payments.

Step 2: Connect to Your Payment Processor

- Inside the SecureQBPlugin settings, connect to your payment processor (which could be a bank or a third-party service provider).

- Ensure the payment processor supports both ACH and FedNow real-time payments.

- Enter your API credentials or login information as required to establish the connection between QuickBooks, SecureQBPlugin, and the payment gateway.

Step 3: Enable ACH and FedNow in QuickBooks

- With the plugin installed and connected to your payment processor, go into QuickBooks settings (for either QBO or Enterprise) to configure payment options.

- Enable ACH and FedNow real-time payments as payment methods for your invoices. This ensures that customers can choose to pay using these methods when they receive a Request for Payment.

3. Creating Request for Payment Invoices with ACH and FedNow Payment Options

Step 1: Generate an Invoice

- Whether you are using QuickBooks Online or QuickBooks Enterprise, create an invoice as you normally would.

- Fill in the required fields, including customer information, line items, and total amount due.

Step 2: Add ACH and FedNow as Payment Methods

- Before finalizing the invoice, choose to include ACH and FedNow as available payment options.

- This feature should be available via the SecureQBPlugin, allowing you to insert real-time payment links directly into the invoice.

Step 3: Send the Invoice with Request for Payment

- Send the invoice to your customer either via email or through QuickBooks' built-in customer portal.

- The customer will receive the invoice with a payment link that allows them to pay via ACH or FedNow. The real-time payment option gives them immediate access to settle the invoice.

4. Processing Payments and Reconciliation

Step 1: Payment Processing

- When the customer chooses to pay via ACH, the funds will typically be transferred within 1-3 business days.

- If they choose FedNow, the payment is processed in real-time, and you receive the funds instantly, 24/7.

Step 2: Automatic Reconciliation in QuickBooks

- The SecureQBPlugin automatically syncs payment information back into QuickBooks, marking the invoice as paid once the funds have been received.

- The status of the payment—whether pending (for ACH) or completed (for FedNow)—will be updated in QuickBooks in real-time, ensuring that your books stay accurate without manual intervention.

5. Benefits of Using ACH and FedNow Real-Time Payments for QuickBooks

- Faster Cash Flow: ACH payments improve cash flow with faster transfers than checks, and FedNow provides instant settlement, giving you access to funds immediately.

- Automation and Time Savings: SecureQBPlugin automates the invoicing and payment collection process, including syncing with your QuickBooks accounts.

- Flexibility for Customers: Offering both ACH and real-time FedNow payments gives your customers flexible, secure, and convenient ways to pay.

- Seamless Reconciliation: Real-time payment processing and updates in QuickBooks reduce the need for manual reconciliation, saving time for your accounting team.

6. Compliance and Security Considerations

- Both ACH and FedNow payments go through highly

secure, regulated banking systems. Ensure that your payment processor

complies with the relevant financial regulations, including:

- ACH Network Rules set by NACHA (National Automated Clearing House Association).

- FedNow Regulations from the Federal Reserve.

- SecureQBPlugin should use encryption and other security features to protect transaction data and customer information.

7. Additional Features of SecureQBPlugin for QuickBooks

- Automated Billing and Payment Reminders: SecureQBPlugin may offer the ability to automate follow-up payment reminders or recurring billing.

- Reporting and Analytics: The plugin can generate reports that track which invoices have been paid and which are still outstanding.

- Multi-user Access: If your business has a team, you can set permissions to allow multiple users to handle invoicing and payments securely.

Conclusion

Integrating ACH and FedNow real-time payments with QuickBooks Online or QuickBooks Enterprise through SecureQBPlugin can significantly improve your payment processing capabilities. By offering real-time payment options, you reduce the time to get paid, streamline operations, and provide better service to your customers. Whether you prefer the more traditional ACH method or want the instant settlement benefits of FedNow, SecureQBPlugin provides a seamless integration to manage these payments from within QuickBooks.

If you need further assistance with the technical setup or any questions regarding payment gateways, feel free to ask!

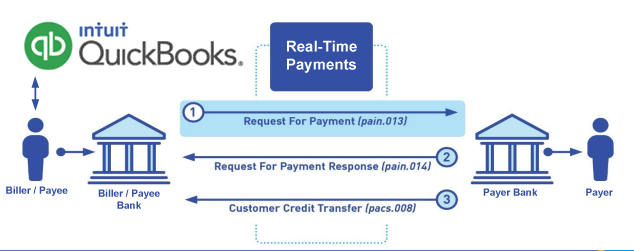

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Our in-house QuickBooks payments experts are standing ready to help you make an informed decision to move your company's payment processing forward.

Pricing with our Request For Payment Professionals

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Create Multiple Templates. Payer/Customer Routing Transit and Deposit Account Number may be required to import with your bank. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Payer Routing Transit and Deposit Account Number is NOT required to import with your bank. We add your URI for each separate Payer transaction.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.