Why Accept Request for Payment (RfP) Services?

Accept Request for Payment Service – FedNow®,

RTP®, and Same-Day ACH Transactions

The Future of Instant & Automated Payment

Requests

For businesses and merchants, delays in payment

processing can lead to cash flow issues, higher transaction costs, and

customer frustration. Traditional invoicing and payment collection

methods rely on outdated banking infrastructure, causing slow

settlements and increased financial inefficiencies.

Enter Request for Payment (RfP). Powered by ISO

20022 messaging, RfP enables businesses, SMB merchants, and high-risk

industries to request and receive instant payments via FedNow®, RTP®,

and Same-Day ACH. This ensures faster settlements, improved cash flow,

and reduced transaction costs across all banks and credit unions.

With TodayPayments, a premier RTP® processor,

merchants can seamlessly integrate RfP via mobile, text, and email with

.html linking, allowing both payees and payers to complete transactions

instantly. Additionally, RTP® Bill Pay enables real-time vendor and

supplier payments for B2B and C2B transactions.

Instant Payment Settlements,

Lower Costs & Improved Cash Flow

For businesses, delayed payments

mean delayed growth. Traditional payment requests rely

on paper invoicing, credit card processing delays, and

ACH batch transactions that can take days to clear.

Key Benefits of RfP Services

for Businesses

✅ Instant Payment

Collection – No more waiting for ACH processing

✅ Lower Transaction Fees – Reduce

credit card and wire transfer costs

✅

Works Across All Banks & Credit Unions – No

third-party restrictions

✅ Eliminates

Chargebacks – Payments are final and irreversible

✅ 24/7/365 Payment Availability –

Works outside traditional banking hours

Industries That Benefit from

RfP Services:

✅

E-commerce & Retail – Instant checkout & supplier

payments

✅ Healthcare & Telemedicine

– Faster insurance claims & patient billing

✅

Legal & Financial Services – Immediate invoice

settlements

✅ Subscription & SaaS

Businesses – Automate recurring payments in real

time

✅ B2B Enterprises – Bulk

payment processing & supplier transactions

Ask us how:

"Accept Request for Payment

(RfP) for FedNow®, RTP®, and Same-Day ACH"

"How to integrate RfP services with all banks & credit

unions for instant business payments"

"Request

for Payments via mobile, text, and email with .html

linking in FedNow® & RTP®"

"RTP® Bill Pay for

B2B and C2B real-time vendor settlements"

"ISO

20022 messaging for secure and automated RfP payments"

How RfP Works for FedNow®,

RTP®, and Same-Day ACH

Seamless Integration with

TodayPayments

Request for Payments (RfP) is a

powerful tool that enables businesses to send instant

payment requests via FedNow®, RTP®, and Same-Day ACH.

Customers can approve payments in real time, reducing

delayed settlements and increasing efficiency.

How RfP Works:

✔ Step 1 – A business sends an

RfP via mobile, text, or email with a .html

payment link

✔ Step 2 – The

customer or payer clicks the secure link and

approves the transaction

✔ Step 3

– The funds are instantly transferred via FedNow®,

RTP®, or Same-Day ACH

✔ Step 4

– Transaction records sync in QuickBooks®, ERPs, and

accounting systems

Why Businesses Should Use

RfP?

✔ Eliminates

Payment Delays – Instant processing instead of

waiting days for ACH

✔ Reduces

Payment Fraud – Secure, ISO 20022-compliant

transactions

✔ Frictionless Customer

Experience – Easy payment approvals via mobile,

text, or email

✔ Works with All Banks

& Credit Unions – No third-party gateway

restrictions

RTP® Bill Pay – Real-Time

Vendor & Supplier Payments

Enhance B2B & C2B Payment

Processing with Instant Settlements

RTP® Bill Pay allows businesses to

process supplier, vendor, and customer payments in real

time, ensuring on-time settlements and eliminating ACH

and wire transfer delays.

How RTP® Bill Pay Works:

✔ Step 1 – Business generates an

invoice or bill via QuickBooks® or ERP software

✔ Step 2 – The vendor receives a

real-time payment notification

✔

Step 3 – The payment is completed instantly

through RTP®, with immediate reconciliation

✔ Step 4 – The transaction is

recorded with ISO 20022 messaging compliance

Top Benefits of RTP® Bill Pay

✔ 24/7 Real-Time

Processing – Never miss a payment deadline again

✔ No Credit Card Fees – Direct

bank-to-bank payments reduce costs

✔

Ideal for B2B & C2B Transactions – Automates

supplier payments & customer billing

✔

ISO 20022 Messaging – Ensures structured, secure,

and automated payment tracking

ISO 20022 Messaging – The

Backbone of Request for Payment Services

Why ISO 20022 is Critical for

Businesses Using FedNow®, RTP®, and Same-Day ACH

ISO 20022 messaging ensures that

all RfP, RTP®, and FedNow® transactions are

structured, standardized, and secure.

✔ Automated Payment

Reconciliation – Reduces manual data entry errors

✔ Fraud Prevention & Enhanced Security

– Protects businesses from unauthorized transactions

✔ Standardized Global Transactions –

Works across multiple financial institutions

By adopting ISO 20022-compliant RfP

services, businesses can improve financial tracking,

regulatory compliance, and operational efficiency.

Accept RfP Payments Today

with TodayPayments

Your business deserves faster, more

reliable, and lower-cost payment solutions. Whether

you're an SMB, enterprise, or high-risk merchant,

TodayPayments ensures you can accept real-time RfP

transactions through all banks and credit unions.

With

TodayPayments, a premier RTP® processor, you

get:

✔ Instant Request for Payment

services with FedNow®, RTP®, and Same-Day ACH

✔

RfP via mobile, text & email with .html payment links

✔ RTP® Bill Pay for B2B & C2B real-time

vendor transactions

✔ Lower processing

fees & no chargebacks

✔ ISO

20022-compliant transactions for security & automation

🚀 Upgrade your

business to real-time payments today! 🚀

Creation Request for Payment Bank File

Enhance Your Payment Requests with

FedNow’s ISO 20022 Messaging

Streamline Payments with Advanced

Request for Payment Options:

Harness the power of FedNow's

Request for Payment

system to transform how you manage invoices and remittances. Our

platform supports diverse data integration options, allowing

payees to incorporate detailed invoice data directly within the

RfP message or link to a comprehensive Merchant Page.

Flexible Invoice Details with ISO

20022 Messaging:

Leverage the flexibility of ISO

20022 messaging standards in our RfP system. You can choose to

display crucial payment details directly in the message with a

concise 140-character description, or through a dynamic

"Hyper-Link" leading to a detailed Merchant Page. This Merchant

Page can be hosted either on your website or

TodayPayments.com/HostedPaymentPage.html

through our seamless integration solution.

Customizable Merchant Pages for

Enhanced Customer Experience:

Create a Merchant Page that not

only details all the MIDs you own but also presents these

options attractively to your customers through the RfP. This

customization ensures that whether your payer opts for

Real-Time

Payment,

Same-Day ACH, or Card transactions, they can easily

navigate and complete their payments through a simple click on

the hyperlink provided on your Merchant Page.

Detailed Payment Information and

Streamlined Processes:

By adopting ISO 20022

specifications, our system enables you to enrich the RfP

messages with customized, detailed information that facilitates

more than just transaction efficiency—it optimizes your entire

payment and accounting processes. This added detail helps in

streamlining operations, reducing errors, and enhancing the

payment experience for both payers and payees.

Optimize Your Transaction Process

with FedNow and ISO 20022:

Embrace the future of financial

transactions by integrating these advanced capabilities into

your payment systems. Our solutions not only provide the

technical sophistication needed to handle detailed transaction

information but also offer the flexibility and user-friendliness

necessary to meet the diverse needs of modern businesses and

consumers.

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's. (Payer's) bank.

Creating a "Request for Payment" from a Payee to a Payer using ISO 20022 PAIN.013 message type for both FedNow and Real-time payment services through "Hubs" with banks requires careful consideration of the specific requirements of each payment system involved. While PAIN.013 is typically used for financial institution transfers, it can be adapted for your purpose.

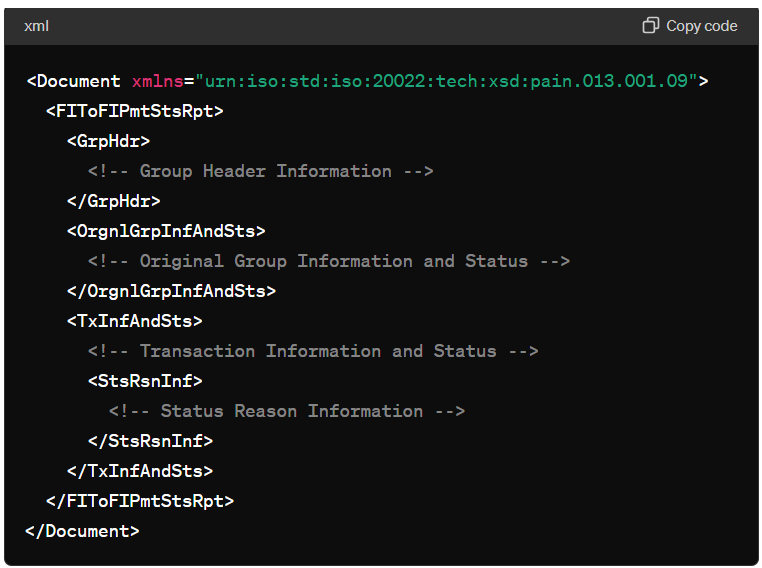

Here's a generalized structure for a PAIN.013 message adapted for your scenario:

- Document is the root element of the XML message.

- FIToFIPmtStsRpt represents the Financial Institution Transfer Payment Status Report.

- GrpHdr contains group header information.

- OrgnlGrpInfAndSts contains original group information and status.

- TxInfAndSts contains transaction information and status, which you can adapt for your payment request details.

- StsRsnInf contains status reason information, which you can utilize to provide additional context for the payment request.

You'll need to include specific details relevant to your payment request, such as payment amount, currency, payment due date, payment reference, payer and payee information, etc.

However, the actual structure and content of the message may vary depending on the requirements and specifications of FedNow, Real-time payment services, and the intermediary hubs and banks involved. It's crucial to consult the documentation and standards provided by these systems and entities for the correct message format and content.

Easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform. Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH and Real-Time Payments funding. Our business clients receive faster availability of funds on deposited items and instant notification of items presented for deposit all based on real-time activity. Dedicated to providing superior customer service and industry-leading technology.

Pricing with our Request For Payment Solutions

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory .csv or .xml data for completed ISO 20022 file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our Instant Payment Solution system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create

"Total" (over 600 Mandatory, Conditional &

Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.